salt lake county sales tax

The Auditors office calculates certified tax rates for all entities in the county that levy property taxes. Select the Utah city from the list of popular cities below to see its current sales tax rate.

Utah Sales Tax Small Business Guide Truic

The auction for 2021s tax sale will be held online hosted by Bid4Assets.

. The restaurant tax is an additional 1. Records and accurately maintains all County property ownership. Salt Lake County Property Tax Process - Basics.

The County sales tax rate is. This is the total of state county and city sales tax rates. In other words it is the rate that will produce the same amount of revenue that the entity.

Welcome to the Salt Lake County Property Tax website. By law the annual tax process involves 5 steps. Utah collects a 685 state sales tax rate on the purchase of all vehicles.

2016 Tax Sale Results. Ad Find Out Sales Tax Rates For Free. 7705 or email to taxmasterutahgov.

Prior to the auction Salt Lake County provides a list of the properties up for auction. 2018 Tax Sale Results. Some dealerships may also charge a dealer documentation fee of 149 dollars.

89 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions. A county-wide sales tax rate of 135 is applicable. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824.

The various taxes and fees assessed by the DMV include but are. If the original owner cannot be contacted the excess funds are sent to the Utah State Treasurer Unclaimed Property Division. 2021 Tax Sale Properties.

Wayfair Inc affect Utah. If you would like information on property owned by Salt Lake County please contact Salt Lake County Facilities Management at 385-468-0374. These are all NO RESERVE auctions.

A single 500 deposit plus a 35 non-refundable processing fee is required to participate in the Salt Lake County UT Tax Sale. The December 2020 total local sales tax. Utah has recent rate changes Thu Jul 01 2021.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. The state sales tax rate in Utah is 4850. With local taxes the total sales tax rate is between 6100 and 9050.

81 W Brooklyn Ln South Salt Lake UT 84115 515000 MLS 1798135 A very well thought out townhome community with great access to TRAX and downtow. Salt Lake County UT Auditor is offering 253 parcels for auction online. 2019 Tax Sale Results.

Essentially the tax sale is an opportunity to buy property for the delinquent taxes owed on the property in an auction format. Lowest sales tax 61 Highest sales tax. The Utah sales tax rate is currently.

Salt Lake County Auditor. The Salt Lake City sales tax rate is. Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property.

Salt Lake County UT Sales Tax Rate The current total local sales tax rate in Salt Lake County UT is 7250. Current Tax Sale List. 2022 Utah state sales tax.

Exact tax amount may vary for different items. 3 beds 25 baths 2054 sq. The value and property type of your home or business property is determined by the Salt Lake County Assessor.

See Publication 25 Sales and Use Tax General Information. 274 rows 2022 List of Utah Local Sales Tax Rates. Residential property owners typically receive a 45 deduction from their home value to determine the taxable value which means you.

22 rows The Salt Lake County Sales Tax is 135. 2021 Tax Sale Results. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835.

Fast Easy Tax Solutions. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Bids start as low as 2700.

The list includes the parcel number owner. Past Years Tax Sale Results. What is the sales tax rate in Salt Lake City Utah.

2017 Tax Sale Results. The minimum combined 2022 sales tax rate for Salt Lake City Utah is. The certified tax rate is the base rate that an entity can levy without raising taxes.

Sales and Use Tax Salt Lake City Utah has a 685 sales and use tax for retail sales of tangible personal property and select services which include but are not limited to admissions to places of amusement intrastate transportation service and hotel and motel accommodations. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. In addition to taxes car purchases in Utah may be subject to other fees like registration title and plate fees.

Budgets are generated by 72 County entities that perform public services like schools libraries cities etc. Remember in your area you only utilize and fund a subset of these services. Did South Dakota v.

You can find these fees further down on the page.

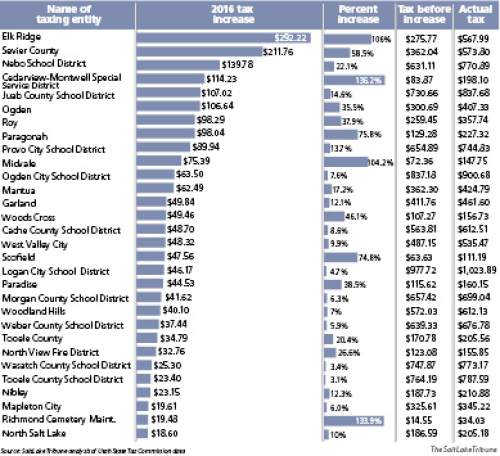

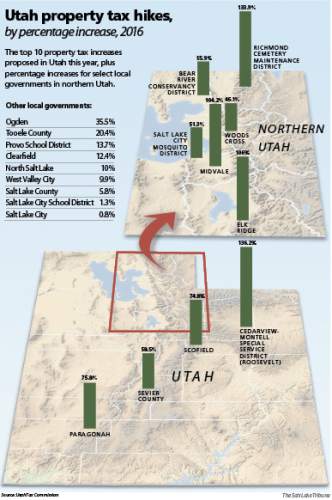

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

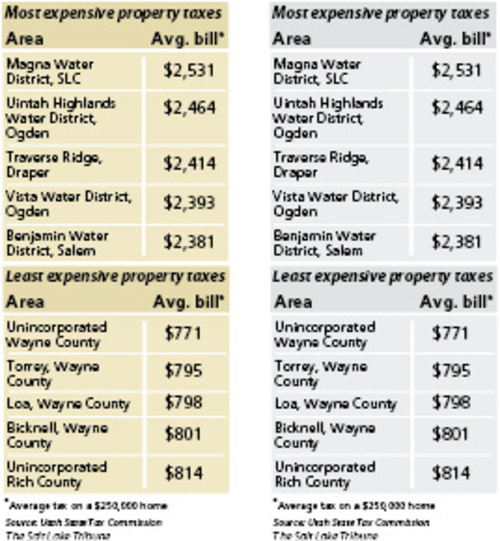

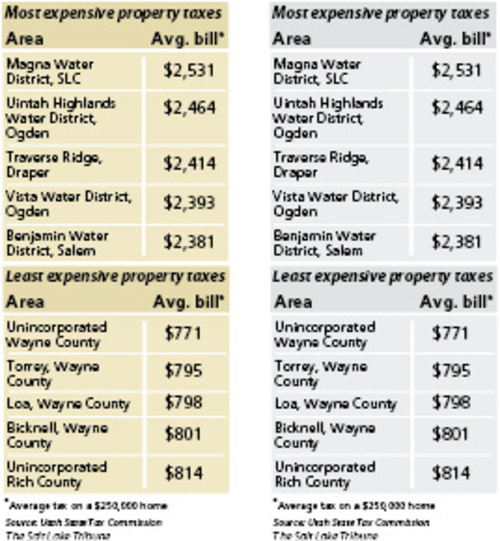

Where Utah Taxes Are Highest Lowest The Salt Lake Tribune

What S Living In Salt Lake City Like 2022 Ultimate Moving To Slc Guide

Very Strong Negative Response To Utah Tax Reform Pollster Says Deseret News

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

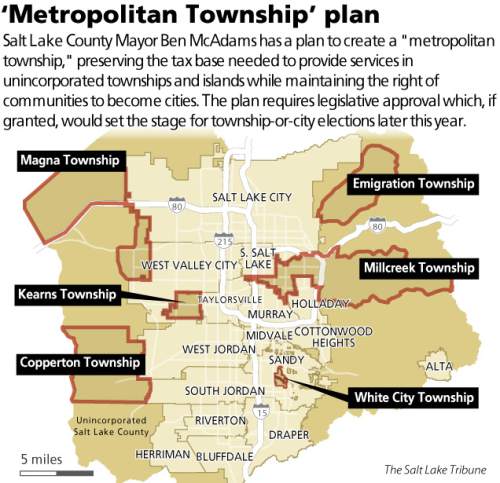

Salt Lake County Looking To Create A Metropolitan Township The Salt Lake Tribune

Salt Lake County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Salt Lake City Utah S Sales Tax Rate Is 7 75

Salt Lake County Looking To Create A Metropolitan Township The Salt Lake Tribune

Amazon Com Salt Lake County Utah Zip Codes 48 X 36 Paper Wall Map Office Products

Salt Lake City Utah Tourism Visit Salt Lake

![]()

Tax Information Economic Development

You Ll Pay 540k For A Median Priced House In Salt Lake County As Sales Slip Again